Cryptocurrency markets are maturing fast, and perpetual futures have become the finnest choice for traders seeking flexibility, liquidity, and the ability to trade both rising and falling markets. For experienced traders, the platform you choose matters a lot, especially in trading efficiency, fee structure, and risk management.

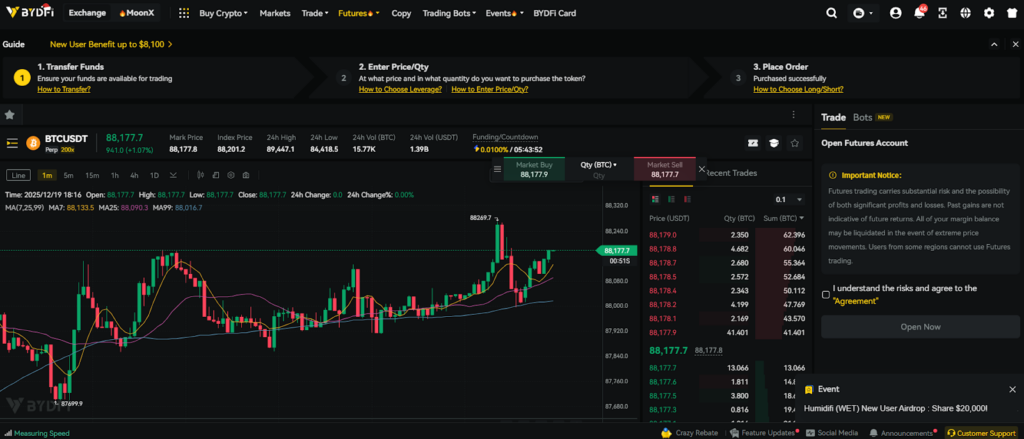

One of the finest platforms is BYDFi, which is a professional-grade platform meant to support active and strategy-driven perpetual traders. It offers hundreds of trading pairs, high leverage options, and a recently upgraded perpetual trading system. Let’s take a look at why BYDFi is a reliable platform for serious traders.

Perpetual Trading on BYDFi

BYDFi allows traders to invest in perpetual contracts. This involves speculating on cryptocurrency price movements without worrying about the expiry date. Unlike normal futures, these contracts are always open, and the prices are based on the spot market.

If you want to explore BYDFi perpetual trading features, you can get access to over 500 trading pairs. It covers all kinds of major assets and altcoins. You can use leverage up to 200x on perpetual contracts, depending on your strategy. High leverage will increase capital efficiency, but low leverage is suitable for long-term risk management.

Traders can explore some margin options like isolated margin, which allows them to limit the risk allocated to a specific position, and cross margin, which shares available funds across positions to reduce liquidation risk.

BYDFi supports both USDT-M and Coin-M perpetual futures:

- USDT-M Perpetuals: Margined and settled in USDT, it offers simplicity and predictable collateral valuation.

- Coin-M Perpetual: Margined and settled in the underlying cryptocurrency, it appeals to traders who prefer to hold crypto-denominated collateral.

Perpetual Trading Fees to Consider

Before engaging in perpetual trading, you need to consider the available fees. Fortunately, BYDFi has a competitive and transparent fee structure. For the trading fees, BYDFi uses a tiered model, ranging from 0.02% to 0.04% depending on the order type and user level.

Like with most perpetual contracts, funding fees are exchanged periodically between long and short traders. Depending on the market conditions, the fees can be positive or negative, and that keeps perpetual prices aligned with spot prices.

As for the withdrawal fees, these vary by cryptocurrency and reflect the network conditions rather than fixed platform costs. Although fees are only a part of overall trading performance, BYDFi has a transparent and reliable fee structure that supports serious traders and active position management.

New Perpetual Trading Upgrades on BYDFi

BYDFi recently announced major upgrades to its perpetual trading system. The updates improve the core functionality of the trading platform. There are three main features meant to improve trading flexibility and fund utilization.

Unrealized Profits Open New Positions

This feature allows traders to use unrealized profits from open positions as a margin to open new ones without waiting to close existing trades. By unlocking capital that would have remained inactive, traders can instantly respond to market opportunities.

In fast-moving markets, this functionality can improve fund efficiency because it allows traders to immediately reinvest. It represents a major shift from traditional models where profits must be realized before being reused.

Hedging for Long-Short Positioning

The upgraded hedging function on BYDFi allows users to hold both long and short positions at the same time on the same trading pair. This capability supports more advanced strategies, including risk hedging and income locking during periods of market uncertainty.

Traders can use this feature to manage exposure to perpetual futures, especially in volatile or range-bound conditions, without having to close the existing positions.

Cross Margin Mode

With cross margin mode, all available funds in a trader’s account are pooled to support multiple positions. The system automatically allocates margin across open trades, reducing the chances that a single position triggers liquidation.

This approach can improve overall account stability, especially for traders that manage several positions at once. It also reduces the need for manual margin adjustments.

How to Trade Perpetual Contracts on BYDFi

If you want to get started with perpetual trading on BYDFi, you can follow the steps below:

- Create an Account: Sign up on BYDFi and complete the identity verification process to unlock additional features and bonuses.

- Deposit Funds: Deposit cryptocurrency or supported fiat options. Most traders convert funds to USDT so they can easily access USDT-M perpetual contracts.

- Transfer to Futures Wallet: Funds must be transferred from the spot wallet to the USDT-M Futures or Coin-M Futures account before trading.

- Select a Trading Pair: Choose from the available perpetual pairs, as BYDFi offers major and emerging cryptocurrencies.

- Set Leverage and Margin Mode: Adjust leverage up to 200x and choose between isolated or cross margin, depending on your risk approach.

- Place an Order: Select the order type, position size, and direction. Traders can set take-profit and stop-loss levels for risk management.

- Manage or Close the Position: Positions can be adjusted or closed manually, or automatically through preset TP/SL orders.

Final Thoughts

BYDFi’s perpetual trading platform has been designed with active, serious, and experienced traders in mind. It supports USDT-M and Coin-M contracts, an extensive range of trading pairs, and leverage options up to 200x, offering flexibility for diverse strategies. Its recent system upgrades improve capital efficiency and position management. Although BYDFi equips traders with tools for better decision-making and risk control, keep in mind that perpetual trading always carries risk.